Unlock Your Success: A Guide to Your Spice Business!

Table of Contents

Introduction

- Understanding the Spice Business Landscape

- Benefits of Properly Registering Your Spice Business

- Choosing Your Business Structure: The Core Decision

- Step-by-Step Process for Registering a Spice Business in the USA

- Disclaimer

- Frequently Asked Questions (FAQs)

- Disclaimer

- Conclusion: Spice Up Your Entrepreneurial Journey

Introduction

For entrepreneurs, this presents a promising opportunity. Whether you plan to open a retail shop, run an online store, distribute wholesale, or manage import/export operations, starting a spice business can be profitable. However, understanding the registration process and legal requirements is critical. Skipping these steps or overlooking regulations can result in costly penalties and setbacks.

This guide provides a step-by-step approach to registering a spice business in the United States as of 2025. It covers:

- Choosing the right business structure

- State and federal registration requirements

- Food safety and FDA compliance

- Legal fees and expected costs

Drawing on guidance from the U.S. Small Business Administration (SBA), Internal Revenue Service (IRS), Food and Drug Administration (FDA), and state-specific regulations, this resource is designed to help entrepreneurs set up legally and confidently.

Compliance is not optional. For example, violations of FDA food regulations or state business laws can lead to fines of up to $1,000 per incident. Understanding these requirements before launching protects your business from unnecessary risks.

Starting a spice business in 2025 – 2026 is a promising opportunity in a growing market. By following the correct steps—from selecting a legal structure to meeting FDA requirements—you can build a business that is both compliant and profitable.

Expect to budget between $500 and $5,000 for registrations, permits, and insurance. While these costs may feel like an obstacle, they are a critical investment that protects your personal assets, enhances your credibility, and establishes a foundation for long-term growth.Success ultimately depends on quality sourcing, food safety, and effective marketing of your unique blends. Use professional advice when necessary, and take advantage of free resources such as SBA.gov for guidance.With diligence and commitment, your spice venture can grow from a small startup into a trusted brand that brings flavor to kitchens across the nation.

2. Understanding the Spice Business Landscape

The spice industry covers every stage from sourcing and processing to packaging and sales. Entrepreneurs can choose from multiple business models:

- Home-based operations such as selling at farmers’ markets.

- Retail stores offering a variety of spices and blends.

- E-commerce platforms reaching national or global customers.

- Import businesses sourcing directly from producing countries like India, Vietnam, or Mexico.

Each model comes with unique regulatory responsibilities, especially if importing, where additional documentation and compliance are required.

Why 2025 - 2026 Is the Right Time

The industry continues to benefit from strong consumer trends. Plant-based diets and wellness-focused lifestyles have increased demand for spices known for their health benefits, including anti-inflammatory properties. According to the U.S. Small Business Administration (SBA), food-related startups enjoy a 20% higher survival rate than the average small business, largely due to consistent consumer demand.

Regulatory Considerations

Because spices are classified as food products, they fall under FDA oversight. Compliance involves safety checks, labeling requirements, and strict controls for imported products. Recalls in recent years due to contaminants such as salmonella or heavy metals highlight the importance of rigorous testing and documentation.

Challenges and Opportunities

Entrepreneurs face challenges such as supply chain disruptions—exacerbated by global events and shifting logistics—as well as increasing competition. Yet, opportunities remain significant.

3. Benefits of Properly Registering Your Spice Business

- Legal Protection

Choosing a formal structure, such as a Limited Liability Company (LLC), separates personal assets from business liabilities. This protection is vital if legal action arises—for example, from a contaminated batch or labeling dispute. - Tax Advantages

With an Employer Identification Number (EIN), businesses can access tax deductions on imports, equipment, packaging, and marketing expenses. Proper registration also streamlines federal and state tax compliance. - Credibility and Access to Funding

A registered business signals professionalism and reliability. This credibility makes it easier to secure financing, such as SBA loans of up to $5 million. In 2025, spice startups also qualify for programs like the USDA Value-Added Producer Grants, which can award up to $250,000 to support product development and expansion. - Food Law Compliance

Registration with the FDA ensures your spices meet national food safety standards. Without it, shipments risk being held at ports or seized, preventing sales across state lines. - Scalability and Growth

A formally registered business can expand into wholesale distribution, export markets, and retail partnerships far more easily than unregistered operations.

The Risks of Skipping Registration

Unregistered businesses face serious consequences, including IRS audits with fines of up to $10,000 and FDA import alerts that can stop shipments entirely. With heightened food safety oversight in the post-COVID era, proper registration in 2025 is not optional—it’s essential.

4. Choosing Your Business Structure: The Core Decision

The first major decision is selecting a legal structure. Each option has distinct implications for liability, taxation, and compliance.

- Sole Proprietorship – Simple and inexpensive to set up, often requiring just a DBA registration. However, there is no separation between personal and business assets, leaving you personally liable for debts or lawsuits.

- Limited Liability Company (LLC) – The most common choice for spice businesses. An LLC separates your personal assets from business liabilities, providing protection if legal claims arise. Setup requires filing Articles of Organization with your state, costing between $50 and $500 plus annual renewal fees.

- Corporation – Suitable for companies planning to scale significantly or attract outside investors. Offers strong liability protection but requires more complex reporting and tax obligations.

5. Step-by-Step Process for Registering a Spice Business in USA

Step 1: Select and Register a Business Name

Choose a unique business name that avoids generic terms (e.g., “Spice Co.”). To protect it:

- Check availability through the S. Patent and Trademark Office (USPTO) and your state’s business registry.

- Register a DBA (“Doing Business As”) if operating under a trade name.

- Secure your domain name and social media handles early to build brand consistency.

Step 2: Obtain an Employer Identification Number (EIN)

Apply for an EIN through the IRS (Form SS-4, free, online). This acts as your business’s tax ID and is required for:

- Filing federal and state taxes

- Opening a business bank account

- Hiring employees

Even sole proprietors need an EIN if engaged in imports.

Step 3: Register for State and Local Taxes

Register with your state’s revenue department to collect sales tax—a must for spice retailers. States may also require additional tax permits depending on where you sell.

Step 4: Secure Business Licenses and Permits

Food-related businesses require specific licenses, including:

- Health Department permits for handling and processing spices.

- Zoning approvals if operating from home.

- FDA Facility Registration (free, renewed every two years) for businesses that manufacture, package, or store food.

- Import Requirements: Submit prior notice for spice shipments and follow Good Manufacturing Practices (GMP).

If selling online across states, you may not need a federal license, but you must comply with state sales tax nexus

Step 5: FDA-Specific Registration for Spice Businesses

The FDA enforces the Food Safety Modernization Act (FSMA):

- Conduct a hazard analysis and implement preventive controls.

- Maintain proper labeling, including allergens and nutrition facts.

- For imports, ensure inspection clearance from APHIS (Animal and Plant Health Inspection Service) to prevent pest contamination.

Step 6: Open a Business Bank Account and Insurance

Keep business and personal finances separate to maintain liability protection. Essential coverage includes:

- General liability insurance for everyday risks.

- Product liability insurance to protect against spice recalls or contamination claims.

Step 7: Post-Registration Compliance

After setup, stay compliant by:

- Filing annual state reports and renewing permits.

- Keeping detailed records for FDA inspections.

- Tracking import codes (e.g., HTS Code 0910 for spices) to avoid customs issues.

Disclaimer

Under no circumstances shall the author, publisher, or any affiliates be liable for any loss, damage, or harm of any kind incurred as a result of your use of this site or reliance on any information provided in this post. Your use of this information and any decisions you make based on it are solely at your own risk.

This post discusses topics related to business registration, legal fees, FDA regulations, and other aspects of starting a spice business in the USA. However, laws and regulations can vary by state, locality, and individual circumstances, and they may change over time. This content does not constitute legal advice, tax advice, or business consulting, and it is not a substitute for professional guidance from qualified attorneys, accountants, or other experts. We strongly encourage you to consult with licensed professionals before taking any actions based on the information in this post to ensure compliance with applicable laws and to address your specific situation.

If this post contains links to external websites or resources, we do not endorse, guarantee, or assume responsibility for the accuracy or reliability of any information offered by those third-party sites. We are not responsible for monitoring transactions or interactions with third-party providers.

By reading and using this blog post, you acknowledge and agree to the terms of this disclaimer.

Frequently Asked Questions (FAQs)

1. Do I need to register my spice business in every state I sell to?

Yes. While your business structure is registered in one state, sales tax permits and local regulations may require registration in states where you have a significant presence or nexus.

2. What business structure is best for a spice business?

A Limited Liability Company (LLC) is generally recommended. Sole proprietorships are cheaper but carry higher liability risks.

3. Do I need FDA registration to sell spices?

Yes, if you manufacture, package, or import spices that will be sold across state lines. Compliance with FSMA is required.

4. Can I sell spices from my home kitchen?

It depends on your state’s cottage food laws. Many states allow home production of low-risk foods like dried spices, but you may still need health permits and zoning approvals.

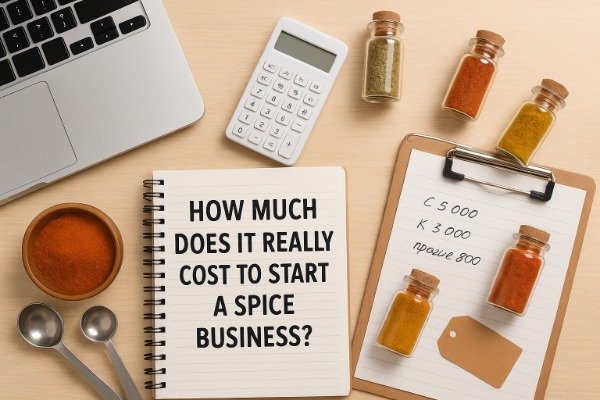

5. How much does it cost to start a spice business legally?

Costs typically range from $500 to $5,000 for registrations, permits, and insurance. Additional costs may include FDA compliance, licensing, and professional consultation.

6. Is product liability insurance necessary?

Absolutely. It protects against claims of injury, illness, or contamination caused by your products and is often required by retailers or distributors.

7. Do I need a separate bank account for my spice business?

Yes. Keeping personal and business finances separate maintains liability protection and simplifies tax compliance.

8. How can I ensure my spices meet safety standards?

Follow FDA FSMA guidelines, implement Good Manufacturing Practices (GMP), maintain proper labeling, and conduct regular quality checks. Imported spices may also require APHIS inspections.

Disclaimer

The information provided on this blog is for educational and informational purposes only and is not legal, financial, or professional advice. While we strive to provide accurate and up-to-date information, we make no warranties or guarantees regarding the completeness, accuracy, or applicability of the content to your specific circumstances.

Before starting a spice business or taking any legal or financial action, you should consult with a qualified attorney, accountant, or other licensed professional. We are not responsible for any losses, damages, or legal consequences that may result from reliance on the information provided on this blog.

Conclusion: Spice Up Your Entrepreneurial Journey

Launching a spice business in the United States in 2025 offers strong potential in a market that continues to grow. By carefully following the registration process—from choosing the right business structure to meeting FDA compliance requirements—you can establish a business that is both legally sound and financially sustainable. On average, expect to invest $500 to $5,000 in registration and legal fees, depending on your structure and state-specific rules.

While these costs may feel like a hurdle, they serve as one of the most important investments you will make. Proper registration not only gives you the legal right to operate but also protects your personal assets, strengthens your credibility, and creates a foundation for scaling into wholesale or export markets.

Success in this industry ultimately comes from quality sourcing, consistent compliance, and effective marketing of your unique blends. Make use of professional guidance where needed, and leverage resources such as SBA.gov for free tools and up-to-date regulatory support.

With diligence and planning, your spice venture can move beyond the startup phase and grow into a trusted brand that flavors kitchens nationwide.